by James M. Klas

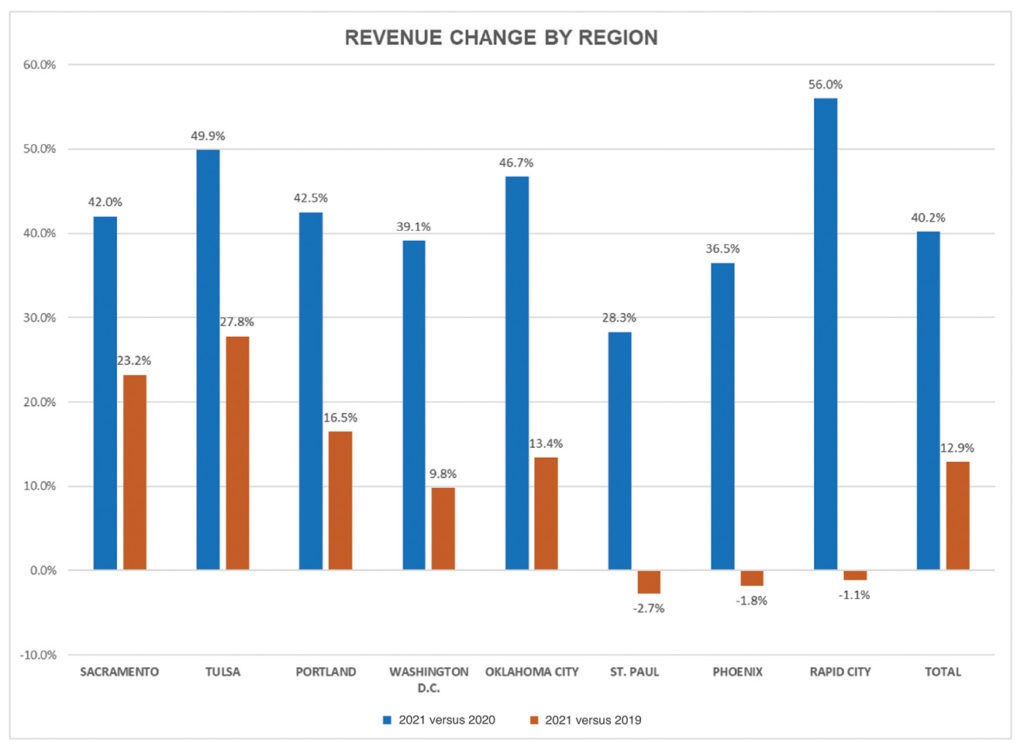

Once again, the NIGC announced its annual revenue figures for Indian gaming for the prior year at the Oklahoma Indian Gaming Association conference in Tulsa. Indian gaming captured just over $39 billion dollars in gaming win in 2021, up 40.2 percent from the pandemic-closure disrupted year of 2020. While the trend was not a complete surprise, the magnitude of the increase was remarkable. Not only did Indian gaming recover all of the ground lost the year before, it swept by the previous 2019 record year by 12.9 percent, setting a strong new record.

On its face, the massive jump in revenue is wonderful news for Indian casinos. Every region experienced an increase of at least 28.3 percent from 2020 and only three regions failed to break the 40 percent mark for year over year increases. It is an exciting and worthy tribute to the customer appeal of Indian gaming; to the professionalism of Indian casino managers and marketing executives; to the resilience of an industry that was completely closed for parts of 2020 and continued to suffer sporadic closures and capacity constraints or operating restrictions in 2021; and, above all, a tribute to the prudent, often more conservative, approach taken by tribes across the country in protecting their people, staff and customers from the worst of the ravages of the pandemic.

Without minimizing the good year, a deeper dive into the NIGC data shows that the experience of the industry still varied by region and size of facility. Three regions did not fully return to their prior 2019 highs. A fourth region surpassed 2019 but by less than the overall average, which was driven higher by more spectacular performance in two of the largest regions by revenue. The Tulsa region, which covers Eastern Oklahoma and Kansas, experienced by far the greatest increase over its 2019 peak, up 27.8 percent and the second highest increase from 2020 at 49.9 percent. The Sacramento region, the largest by total gaming win, had the second highest increase over 2019 at 23.2 percent but ranked only fifth out of eight regions in its year over year increase from 2020. At the other end, the Rapid City region had by far the highest increase over 2020 at 56 percent, but has still not fully recovered all of its losses from 2019. The Phoenix and St. Paul regions also still trailed 2019 but were toward the lower end of the year over year increases from 2020 as well. Oklahoma City, which covers the rest of Oklahoma and Texas, did not see the same degree of increase as Tulsa and continues to show a lower total win figure than Tulsa after having captured more revenue in 2019. The figure Revenue Change by Region shows the comparative increases in gaming revenue by NIGC regional office area.

After suffering the biggest drops in 2020, the top revenue bracket experienced the greatest increases in 2021, with the total up nearly 100 percent over the prior year. The number of Indian casinos with more than $250 million in revenue nearly doubled in 2021 and was 30 percent higher than in 2019. Indian casinos capturing more than $250 million in gaming win, the top tier for NIGC figures, now account for more than 50 percent of total Indian gaming win despite representing less than nine percent of total properties.

Three of the four revenue categories below $50 million actually showed decreases in total revenue in 2021 from 2020. Much of the change in revenue direction comes from movement between the categories as casinos that fell into lower categories in 2020, shifted to higher categories in 2021. The number of casinos in the bottom four categories dropped to 349 in 2021, from 401 in 2020. However, many of the casinos located in the Rapid City and St. Paul regions, which have not yet fully recovered regionally, fall into the lower revenue tiers and could also account for part of the overall decline. Despite the overall upward trend for the industry, the total number of casinos decreased by 14 nationwide.

On an average per property basis, three revenue ranges had higher averages than last year while the other four were lower rather than higher. Even for average per property figures, it is important to note that for all but the top and bottom tiers, movement out of a tier in 2021 would come from the highest performing properties while movement into a tier would come from properties that previously performed at lower levels and most likely still perform below average for their new tier.

Although the across-the-board positive experiences of 2021 versus 2020 and the new heights achieved in many regions give reason for optimism, it is important to remember that many operations are still trying to regain their momentum. There are many situations, particularly in some of the higher performing regions along the west coast, of casinos that are tracking year-to-date in 2022 below what they saw in 2021. While a region wide retrenchment from 2021 numbers is not predicted, there is enough evidence that some areas experienced an artificial boost in 2021 from pent up demand, substantial government subsidies, extra spare time and differences in capacities, availability, operating restrictions and perceived safety between casinos and other recreational forms. In particular, vacation travel is taking more people out of their home territories this year and diverting funds they may have spent last year at area casinos.

Aside from whatever anomalous demand shifts occurred in 2021, the industry is facing serious headwinds this year in the form of high inflation rates and significant labor and supply shortages. While there is some limited evidence that both situations may be moderating, the evidence is far from comprehensive or conclusive. With operating costs rising, customer spending under pressure and service delivery continuing to hold back operations from even fully reopening, let alone growth, the continued recovery and possible new growth will be anything but smooth. Nevertheless, after what the industry weathered in 2020, it is anticipated that those staffing and managing Indian casinos across the country will be able to work through the challenges.

The key question hanging over the industry and the economy as a whole is whether or not we will fall into a recession and, if we do, when, how bad and for how long? Recession is a much more serious problem for casinos than inflation. Based upon the evidence to date, it does not appear we have entered a recession as of yet and it is still possible to avoid one, at least one that would be severe or prolonged. However, the warning signs are multiplying as fast or faster than the positive indicators on inflation and labor and supply shortages. We are seriously at risk of making a recession a self-fulfilling prophecy if the relentless media coverage and lack of clear and confident direction from government and central banks continues as it is. Customer and small business confidence are such major drivers of the economic engine that enough negative attitudes can actually instigate what we are trying to avoid. This is not an exhortation for a Ford-era Whip Inflation Now campaign and other pie-in-the-sky sentiment. It is a simple recognition that the level of uncertain but more negative than positive public statements, news and punditry are adding to rather than simply reporting on, the struggles of the economy. While a recession remains a major concern, there is still an outcome that does not include one of any significant degree other than perhaps a shorter-term and shallow dip sometime in 2023 or early 2024.

We do not foreclose the potential for additional Indian gaming revenue growth in 2022. However, it is expected to be modest, if any, and possibly still not clearing the magic $40 billion mark. It as also very possible that 2022 will end up being flat to slightly down, marking part of 2021’s performance as a one-off explosive response from a frustrated customer base that masked and temporarily overwhelmed the underlying operating issues that have not yet been fully resolved.

James M. Klas is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the economic impact and feasibility of casinos, hotels and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email [email protected].