DETROIT, MI – Michigan commercial and tribal casino operators reported a combined $216.4 million total internet casino gaming gross receipts and gross sports betting receipts in March. Gross receipts increased 26.7 percent compared with February results.

March internet gaming gross receipts were a Michigan record of $171.8 million, surpassing the previous total gross receipts record of $153.7 million set in January. Gross sports betting receipts totaled $44.6 million. In March 2022, internet gaming gross receipts were $131.67 million, and gross sports betting receipts were $30.48 million.

Combined total internet gaming and internet sports betting adjusted gross receipts were $186.09 million, including $154.65 million from internet casino gaming and $31.44 million from internet sports betting. Internet gaming adjusted gross receipts increased 30.4 percent from the $118.58 million recorded in March 2022, and internet sports betting adjusted gross receipts improved 114.5 percent from the $14.66 million total recorded in March a year ago.

March 2023 combined adjusted gross receipts were 31.3 percent higher than the $141.73 million in total adjusted gross receipts logged in February 2023.

For the first quarter of 2023, internet gaming adjusted gross receipts totaled $426.3 million, and internet sports betting adjusted gross receipts were $57.7 million. Michigan operators reported $338.3 million in internet gaming adjusted gross receipts and $29.9 million in internet sports betting adjusted gross receipts during the first quarter of 2022.

Total internet sports betting handle at $407.7 million was down 9.7 percent from the $451.6 million handle recorded in March 2022. March 2023 handle was up 18.2 percent from the February 2023 handle of $344.9 million.

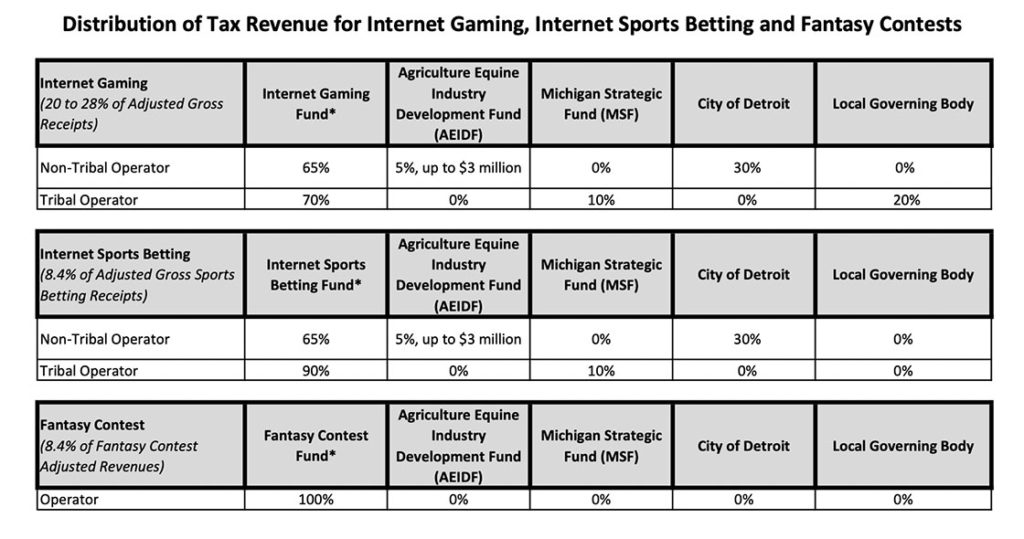

The operators reported submitting $33.2 million in taxes and payments to the State of Michigan during March including:

- Internet gaming taxes and fees: $31.3 million.

- Internet sports betting taxes and fees: $1.9 million

The three Detroit casinos reported paying the City of Detroit $9.1 million in wagering taxes and municipal services fees during March including:

- Internet gaming taxes and fees: $8.2 million

- Internet sports betting taxes and fees: $865,916

Tribal operators reported making $3.7 million in payments to governing bodies in March.

During March, a total of 15 operators offered internet gaming and internet sports betting.