by Matthew S. Robinson

As of July 1, 2024, there were an estimated 90 non-gaming hotels with a total 11,315 rooms owned by more than 50 different tribes and tribal entities (development corporations, partnerships, etc.). These include small lodges in some of the most remote areas of the country to full-service hotels in major U.S. metropolitan areas – and pretty much everything in between. Not included are the more than 60,000 hotel rooms affiliated with Indian casinos in the country. Also not included are hotel properties owned by individual tribal members, passive minority equity investments by tribes or tribally-owned hotel franchise corporations. Table 1 presents a summary of tribally-owned, non-gaming hotels in the U.S. by size.

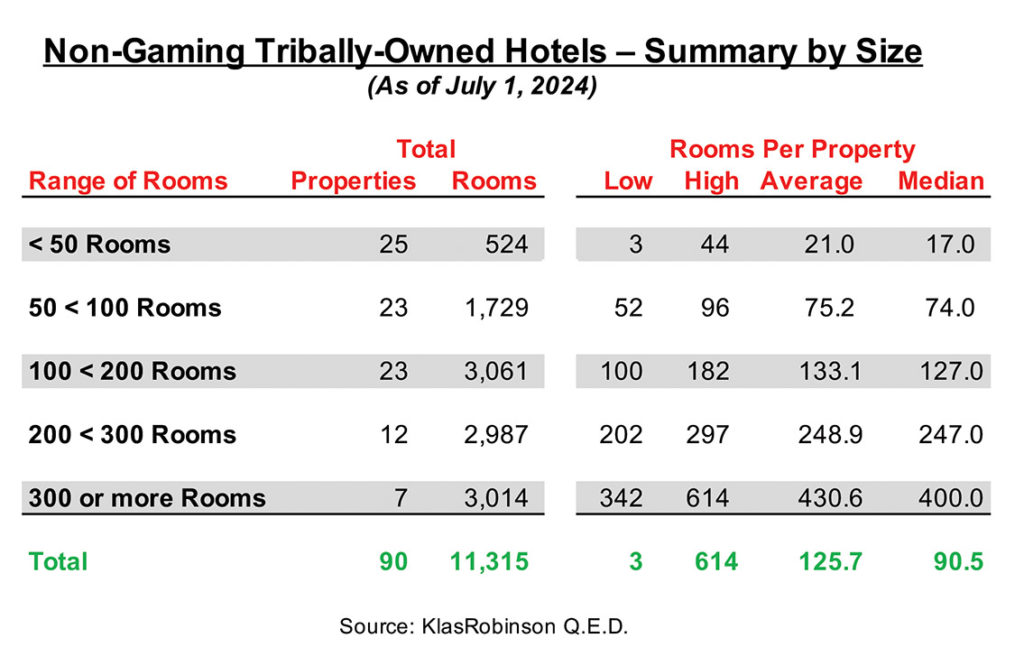

Table 1

The 90 tribally-owned, non-gaming hotel properties range in size from three rooms up to more than 600 rooms, with an average (mean) of 125.7 rooms and median of 90.5 rooms per property. By size, hotel properties with less than 50 rooms account for the greatest number of hotel properties (27.8 percent), followed closely by hotel properties with 50 < 100 rooms and 100 < 200 rooms, each accounting for 25.6 percent of tribally-owned, non-gaming hotel

properties.

As presented in Table 2, the 90 tribally-owned, non-gaming hotel properties are located in 17 different states. These include: 15 properties each in Arizona and California; 12 properties in Alaska; eight properties in Florida; seven properties each in Minnesota and Washington; six properties in New Mexico; five properties in Alabama; four properties in Oklahoma; three properties in Michigan; two properties in New York; and one hotel property each in Connecticut, Washington D.C., Mississippi, North Carolina, Oregon and Virginia.

Table 2

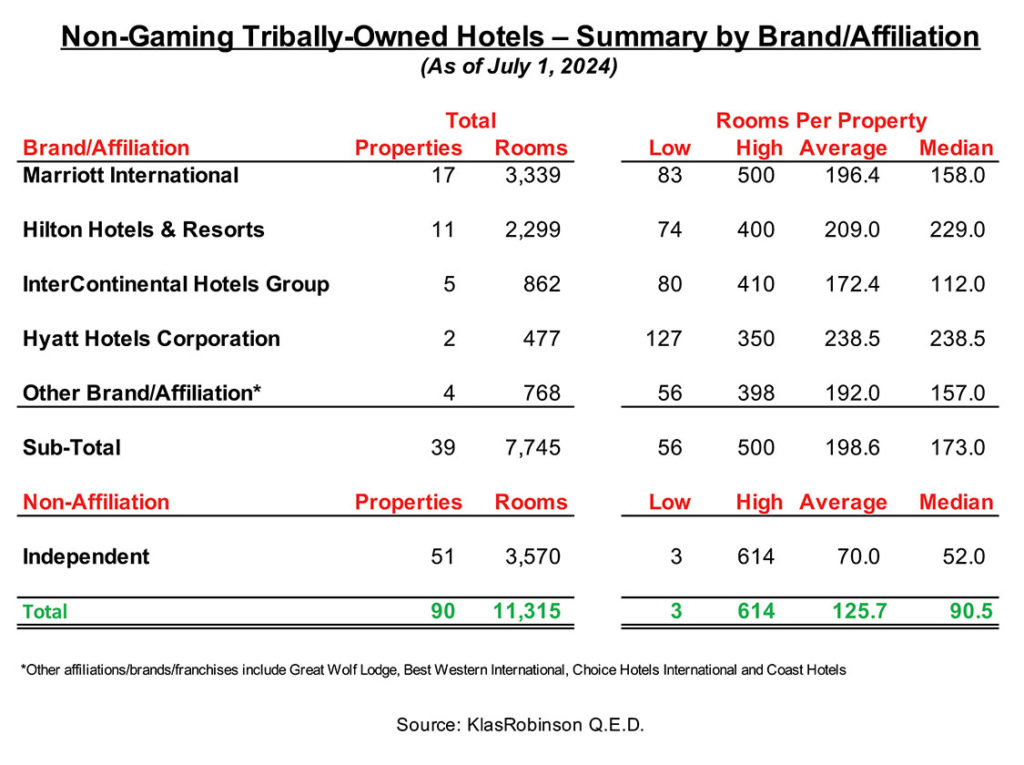

Not only do tribally-owned, non-gaming hotel properties vary by size and location, but by affiliation. Of the 90 tribally-owned, non-gaming hotel properties, 39 hotels (43.3 percent of properties and 68.4 percent of total rooms) carry a national or regional franchise, while 51 hotels (56.7 percent of properties and 31.6 percent of total rooms) are independent with no brand or chain affiliation.

As presented in Table 3, Marriott branded properties account for 43.6 percent of total branded and 18.9 percent of total tribally-owned, non-gaming properties. Tribally-owned Marriott branded properties include Courtyard by Marriott (1 property), Fairfield Inn & Suites (3 properties), JW Marriott (1 property), Marriott AC (1 property), Autograph Collection (1 property), Luxury Collection (1 property), Residence Inn & Suites (4 properties), Sheraton (1 property), TownPlace Suites (3 properties) and Westin (1 property). Hilton branded properties account for 28.2 percent of total branded and 12.2 percent of total tribally-owned, non-gaming properties. Tribally-owned Hilton branded properties include Doubletree (2 properties), Embassy Suites (1 property), Hilton Garden Inn (2 properties), Home2 Suites (2 properties), Homewood Suites (1 property), Tapestry Collection (1 property), Tru (1 property) and Waldorf Astoria (1 property). InterContinental (IHG) branded properties account for 12.8 percent of total branded and 5.6 percent of total tribally-owned, non-gaming properties. Tribally-owned IHG branded properties include Holiday Inn Express (2 properties), Holiday Inn Resort (1 property), Intercontinental (1 property) and Staybridge Suites (1 property). In addition, there are two Hyatt-branded properties – Hyatt Place (1 property) and Hyatt Regency (1 property), as well as one Best Western branded property (Best Western Plus), one Coast Hotel branded property, one Choice branded property (Quality Inn) and one Great Wolf Lodge.

Table 3

In addition to owning a hotel or hotels with a national brand or chain affiliation, what about owning the hotel brand itself? The Seminole Tribe of Florida did just that. In 2007, the Seminole Tribe of Florida acquired the Hard Rock brand. Today, the Seminole Tribe of Florida, through its Hard Rock International, has more than 250 Hard Rock branded Café, Hotel, Casino, Live and Rock Shop venues in 70 different countries, including five non-gaming Hard Rock Hotel franchises here in the U.S.

As tribes continue to grow their economies, the development and/or purchase of non-gaming hotels and related hospitality enterprises will continue to provide a viable option for diversification, particularly for those with existing casino hotel operations.

Matthew S. Robinson is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the feasibility and economic impact of casinos, hotels, resorts and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email [email protected].