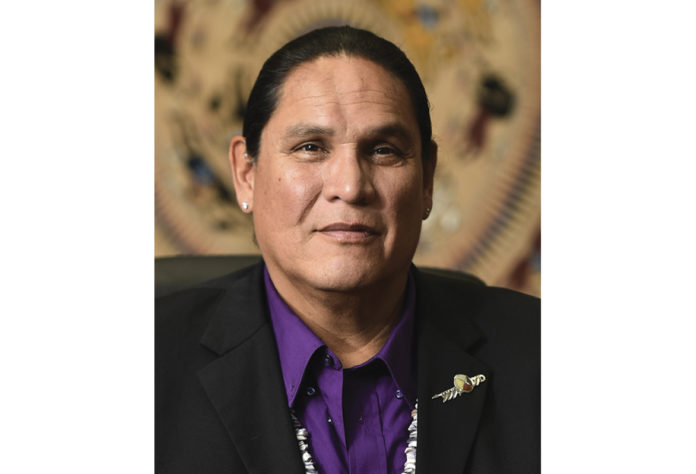

by Ernest L. Stevens, Jr.

On September 17, 2024, the Biden administration’s Treasury Department and Internal Revenue Service (IRS) published a proposed rule to implement the Tribal General Welfare Exclusion Act of 2014 (TGWE or the Act). The Act put a freeze on discriminatory IRS audits of tribal government programs and services and amended the tax code to clarify that the benefits derived from such programs and services are generally exempt from income taxation. The draft regulation, one decade in the making, reflects much of what Congress intended when it passed the Act.

The Internal Revenue Service, in a press release highlighting the announcement, acknowledged that “the proposed regulations affirm the views of Treasury and IRS that Indian tribal governments themselves are in the best position to determine support for their tribal citizens. Thus, under the proposed regulations, Indian tribal governments have flexibility to design general welfare programs that consider the tribe’s unique cultural practices, history and traditions. In addition, the proposed regulations provide deference to Indian tribal governments …, including whether benefits are for the promotion of general welfare and whether benefits are provided in exchange for participation in cultural or ceremonial activities.”

It’s difficult to understate this change in attitude and respect for tribal sovereignty coming from the Treasury Department and the IRS. However, these changes are what Indian Country and Congress intended when we embarked on the effort to enact the Tribal General Welfare Exclusion Act. The primary purposes of the Act were to reform these agencies and better align federal tax policy with federal Indian policy.

Through treaties and executive orders, Indian tribes ceded hundreds of millions of acres of their homelands to help build this nation. In return, the United States made promises to provide for the health, education and general welfare of Native communities. For more than two centuries, the government has fallen far short in meeting these solemn obligations.

Thanks in large part to the success of the tribal government gaming industry through the 1990s, many Indian tribes began to address portions of these shortfalls in federal obligations by enhancing tribal government programs and services to meet the needs of their communities. Indian gaming revenues enabled tribes to deliver health insurance and expand healthcare, provide education and training scholarships to tribal citizens, make improvements to housing, expand on services to children and elders, enhance tribal language and cultural programs, and much more.

In the 2000s, instead of fostering these acts of tribal self-determination, some IRS field agents made unilateral policy decisions to target tribes for audits and investigations. The IRS essentially sought to declare benefits derived from these programs and services as individual income. Field agent decision-making was inconsistent and arbitrary. Activities allowed in one audit were challenged in another.

Tribal governments not under audit were asked to participate in compliance checks by IRS specialists. The Indian Gaming Association received reports from our Member Tribes that IRS agents were urging tribes to issue 1099 forms if they provided backpacks with school supplies to incoming students, burial and funeral assistance to citizens, stipends for families to participate in Pueblo Feast Days, housing repairs to tribal elders, health insurance coverage to citizens, and a myriad of other tribal government programs.

For more than half a century prior to this change in policy to target Indian Country, the IRS gave wide deference to state government programs that provide basic safety net programs to state citizens. The IRS used the “general welfare exclusion” doctrine, an administrative exception to the broad statutory definition of gross income adopted in the 1930s, to justify excluding these state programs and services from income.

In response to the IRS’ unwarranted policy change to target tribes, the Indian Gaming Association helped spearhead a nationwide effort to reform the Treasury Department and the IRS. We coordinated with our Member Tribes and sister organizations to develop the Tribal General Welfare Exclusion Act, which sought to codify the general welfare exclusion doctrine for Indian Country and better align federal tax policy with federal Indian law and policy.

After several years of efforts, the U.S. House of Representatives, under suspension of the rules, passed the Tribal General Welfare Exclusion Act of 2014 by voice vote on September 16, 2014. Two days later, on September 18, 2014, the United States Senate approved the bill by unanimous consent. President Obama signed the bill into law on September 26, 2014, as Public Law 113-168.

In addition to amending the tax code to codify the general welfare exclusion doctrine for Indian Country, the TGWE – for the first time in history – codified the Indian canon of construction. The Act provides that “Ambiguities in section 139E of [the tax code], as added by this Act, shall be resolved in favor of Indian tribal governments and deference shall be given to Indian tribal governments for the programs administered and authorized by the tribe to benefit the general welfare of the tribal community.”

Equally important, the TGWE established the Treasury Tribal Advisory Committee (TTAC). The purpose of the seven-member TTAC is to “advise the Secretary on matters relating to the taxation of Indians,” implement the TGWE, and develop training and education for IRS field agents “who administer and enforce tax laws with respect to Indian tribes….”

As noted above, thanks in large part to the TGWE and the Biden Administration officials at Department of the Treasury and the IRS, we have seen a newfound respect for tribal sovereignty. The publication of these long-awaited draft regulations is a huge step forward for tribes nationwide. The proposed regulations uphold the intent of the TGWE by putting forth a set of rules that defer to tribal governments, recognizing that they are best equipped to determine the needs of their citizens.

The proposed rule is not final, and there is more work to be done. The Treasury Department and IRS have scheduled a series of tribal leader consultations November 18-20, 2024. The deadline to submit written comments is December 17, 2024. We urge all tribal leaders to participate in the series of consultations that will take place in November to ensure the rules fully reflect the needs of Indian Country.

Ernest L. Stevens, Jr. is Chairman of the Indian Gaming Association. He can be reached by calling (202) 546-7711 or visit www.indiangaming.org.