by James M. Klas

NIGC Chairman E. Sequoyah Simermeyer and Vice Chair Jeannie Hovland publicly released the long anticipated totals for Indian gaming industry revenue for 2020 at the Oklahoma Indian Gaming Association annual conference. As bad as last year was, and it was horrible, the fiscal year totals showed the remarkable resiliency of the industry in the face of the greatest calamity in the IGRA era. Total gaming revenue for 2020 was $27.8 billion, down 19.5 percent from 2019 and the lowest total since 2012, according to NIGC data. Considering that every Indian casino in the country was closed for some portion of 2020, some had to close more than once, and some have only just opened in the past two months, the final figures can legitimately be regarded as better than generally expected and as a positive indicator for the future of the industry.

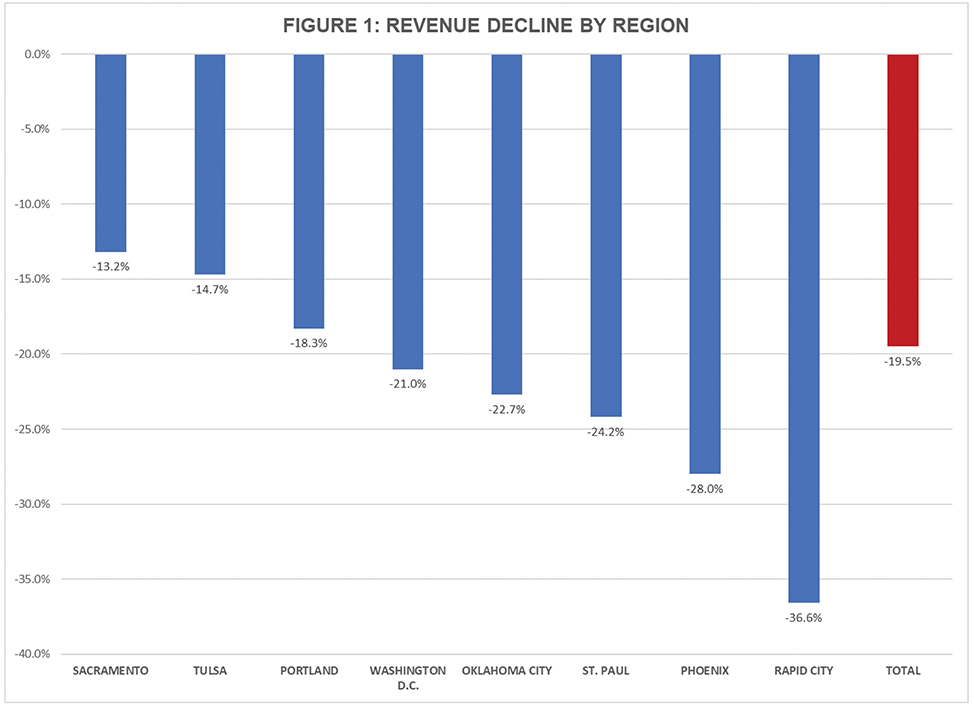

A deeper dive into the NIGC data shows that the experience of the industry varied considerably by region and size of facility. Some areas and properties felt even less of an impact than the national number suggests, while others suffered to a much greater degree. On a regional basis, the Sacramento Office, which covers California and Northern Nevada, experienced the least impact, down 13.2 percent. The Tulsa and Portland Offices also experienced less negative impact than the overall national average. At the other end, the Rapid City Office, which covers the Dakotas, Montana and Wyoming, experienced by far the most serious decline at 36.6 percent from 2019. The Phoenix Office, which includes New Mexico, Colorado and Southern Nevada in addition to Arizona, also felt a sharper impact with a 28 percent decline. Figure 1 shows the comparative declines in gaming revenue by NIGC regional office area.

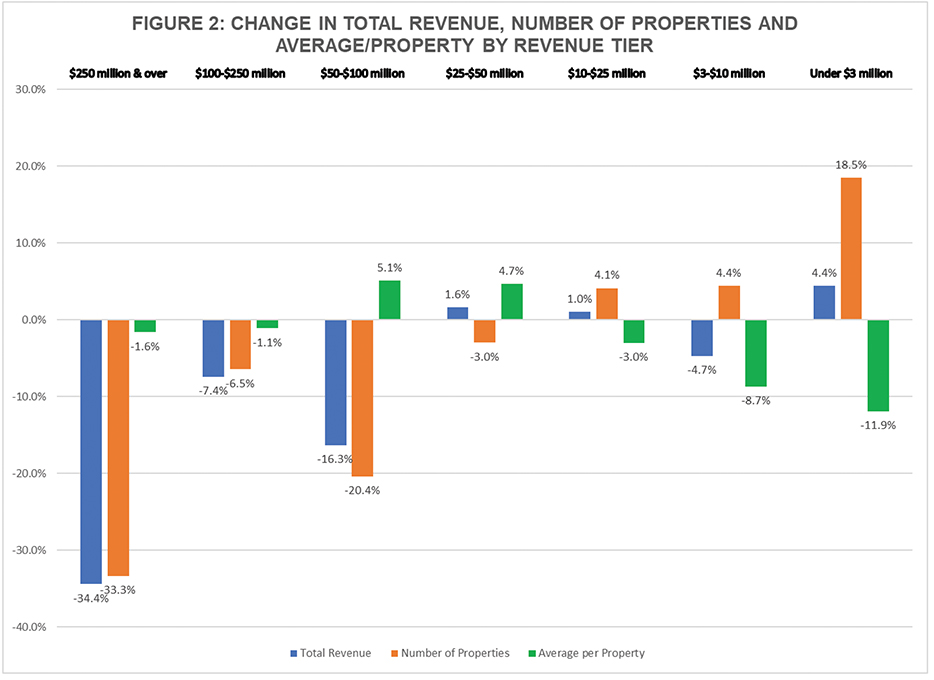

According to the NIGC breakdown by revenue range, the top revenue brackets experienced the greatest declines in total, led by the $250 million and over category, which was down 34.4 percent from 2019. Three of the four revenue categories below $50 million actually showed increases in total revenue in 2020 from 2019. This is not, however, due to somehow outperforming the broader industry. Rather, the positive revenue direction comes from movement between the categories as casinos that achieved higher revenue and fell into higher categories in 2019, shifted to lower categories in 2020. The top revenue category, $250 million and over, lost one-third of its members in 2020, with 11 total casinos dropping to lower levels. At the opposite end, the lowest category, under $3 million, gained 22 more casinos in 2020, an increase of 18.5 percent. The total number of casinos increased by two nationwide.

On an average per property basis, only the two categories between $25 million and $100 million outperformed the prior year, not losing as much as would be expected given the decrease in the number of properties in the category. Even for average per property figures, it is important to note that for all but the top and bottom tiers, losses in a tier would come from the lowest performing properties while gains would come from entry into the category by properties that previously performed at higher levels and most likely still perform above average for their new tier. Figure 2 presents changes in total revenue, number of properties and average revenue per property by revenue tier as published by the NIGC.

Back in February of this year, it was estimated that Indian gaming revenue for 2020 would fall to approximately $25 billion. The industry surpassed that pessimistic prediction by 11.2 percent. Some of the success was driven by revenue growth early in the fiscal year before the pandemic closures and other restrictions took hold. However, the biggest factor in the better than expected performance was the speed with which top customers returned to their favorite casinos, once allowed, and their additional spending per visit over pre-pandemic averages.

The highest value players generally came back fastest and increased their spending, since they had little else on which to spend their recreational dollars. This greatly reduced the impact of capacity reductions mandated for casinos to promote social distancing and reduce viral spread. In markets where other recreational opportunities remained closed, some casinos actually experienced record positive months in 2020 once they reopened and stabilized their operating procedures. The closing of buffets due to fears of viral spread resulted in fewer patrons coming only for the cheap meal and spending little on the gaming floor.

Although the positive experiences of some casinos and the lower than expected losses industry-wide give reason for optimism, it is important to remember that many operations fared much worse than average, never even reopening in 2020. Any industry that suddenly and without warning loses nearly 20 percent of its revenue on average is going to struggle mightily. That was certainly the case for Indian casinos and the owning tribes that depend upon their profits.

The best, and most important, news of all is the speed with which recovery is occurring whenever properties are able to open and where operating restrictions are manageable. It was previously predicted that total industry gaming revenue would not reach its 2019 record level again until 2022. There is now reason to hope that it may actually come close to that level and conceivably surpass it this year. The referenced positive impact of early fiscal months before the pandemic in 2020 will be inverted in 2021 with greater pandemic restrictions and delayed openings weighing down the fiscal 2021 figure. The delta variant continues to threaten economic progress for the late summer and fall. However, the resilience shown in 2020 in the face of the worst of economic restrictions suggests that the industry will not only rebound, but will move forward to even greater future prosperity.

James M. Klas is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the economic impact and feasibility of casinos, hotels and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email jklas@klasrobinsonqed.com.