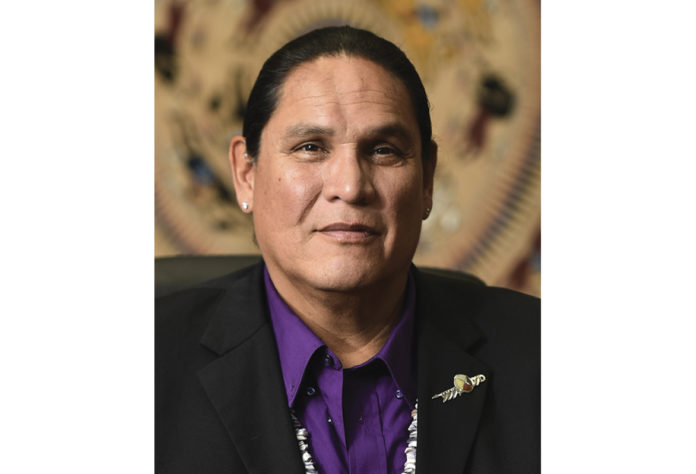

by Ernest L. Stevens, Jr.

Indian nations and tribes are original independent sovereign nations, and our Indian sovereignty long predates America. For thousands of years before America’s foundation, Native nations had democracies and republics, sustainable economies, successful laws, traditions and cultures, and healthy peoples. Among the Haudenosaunee Six Nations Confederacy, the Great Law of Peace set forth the framework for our self-governance since 1100 A.D. Benjamin Franklin and other framers studied our separation of powers and checks and balances for the Constitution (H.R. Concurrent Res. 331, 1988).

During the American Revolution, General Washington sought out Indian nations to assist America in the War with Great Britain. At Fort Pitt, America entered the 1778 Delaware Nation Treaty to establish a military alliance, peace, friendship and commerce. The Delaware foraged for the Continental Army. General Washington relied on the Stockbridge Mohicans in his efforts against the British in New York. The Oneida Nation’s friendship with Washington during the long winters and in support of America’s Revolutionary Army was a turning point in the war. America’s victory at Saratoga, New York, turned back the British and solidified America’s alliance with France.

George Washington served as President of the Constitutional Convention, and he is an authoritative guide to its original understanding. Washington and the framers built a strong federal government because the Continental Congress proved too weak to maintain the peace, manage the national debt, regulate commerce, conduct foreign affairs and conduct Indian affairs during the American Revolution. The U.S. Senate Historian explains, “After fighting between the Americans and the British ended in 1783, the new U.S. Government established under the Articles of Confederation needed to pay off its debt, but lacked sufficient tax authority to secure any revenue.” President Washington believed that a strong federal government capable of managing affairs was essential to the new nation’s success and the Constitutional framers established federal authority in finance, taxation, regulation of commerce, foreign affairs and Indian affairs.

“We, the People” of the United States of America are the Constitution’s source of federal sovereignty. Washington conceived America’s sovereign power to be based upon “the uncorrupted choice of a brave and free people, the purest source and original fountain of all power.” That was an important change from the Articles of Confederation, with federal sovereignty derivative of state sovereignty.

In the Treaty Clause, the Constitution authorizes bilateral nation-to-nation relations between America and Indian nations, and the Commerce Clause affirms that Congress has power to regulate Commerce “with the Indian tribes,” as it does “with foreign nations.” The Supremacy Clause provides:

This Constitution, and the Laws of the United States which shall be made in Pursuance thereof; and all Treaties made, or which shall be made, under the Authority of the United States, shall be the supreme Law of the Land.

“Treaties made” refers to America’s Indian treaties, as well as international treaties ending the Revolutionary War. Washington sought to establish a vigorous Indian affairs policy, entering the 1790 Treaty with the Creek Nation to make peace, restore lands, pay, promote agriculture, and establish trade. Officially, Washington said, “The Government of the United States are determined that their administration of Indian Affairs shall be directed entirely by the great principles of Justice and humanity.”

The Constitution’s Exclusion of “Indians Not Taxed” and Squire v. Capoeman

The newly formed United States of America recognized Native Americans are Indian nation citizens. So, the Constitution’s Apportionment and Direct Taxation Clause excluded “Indians not taxed” (U.S. Const. Art. I, Sec. 2). After the Civil War, Congress and the President framed the 14th Amendment to establish birthright citizenship and amend the Apportionment Clause to strike the prior “3/5s” reference to slavery. At the same time, the amended Apportionment Clause maintained the Constitution’s exclusion of “Indians not taxed” from apportionment of congressional districts and recognized Native citizens as subject to the jurisdiction of tribal governments, not the United States.

In 1924, Congress naturalized Native Americans as U.S. Citizens in the Indian Citizenship Act while reaffirming our connection to our Indian lands unaffected and unimpaired, recognizing our status as dual citizens.

In Squire v. Capoeman, 351 U.S. 1 (1956), the Supreme Court ruled that “Indians are citizens and that in ordinary affairs of life, not governed by treaties or remedial legislation, they are subject to the payment of income taxes as are other citizens.” When Natives earn revenue from allotted Indian trust lands, they are protected by treaty and remedial legislation and not subject to federal income taxation. So when Capoeman sold timber from his trust allotment it was a non-taxable sale. Payments from Indian land settlements, judgment funds, and distributions from tribal trust funds are not subject to income tax because they are tied to Native citizenship and Indian Country homelands.

Tribal General Welfare Exclusion Act

Native nations as original independent sovereigns are not subject to federal income taxation on our essential government revenue. In 2014, Congress determined that when Native nations exercise Indian self-determination to provide government services to tribal members, self-government is treaty-protected and not subject to federal income taxation, under the Tribal General Welfare Exclusion Act.

Treasury Tribal Advisory Committee

The Tribal General Welfare Exclusion Act (TGWEA) establishes a Treasury Tribal Advisory Committee with ongoing responsibility for advising the Secretary of the Treasury “on matters relating to the taxation of Indians,” and education of the Internal Revenue Service Field Agents on Federal Indian Law, the federal government’s unique legal treaty and trust relationship with Indian tribal governments, and the implementation of the Act (26 U.S.C. 139E). Because the TGWEA touches on treaty rights, the Act sets forth the Indian Canon of Statutory Construction: any ambiguity “shall be resolved in favor of Indian tribal governments and deference shall be given to Indian tribal governments for the programs administered and authorized by the tribe to benefit the general welfare of the tribal community.”

Need For Legislation

The Biden administration wrongly decided that the TGWEA Tribal Advisory Committee was a temporary Federal Advisory Committee and to support the IRS statutory interpretation, it was suggested the Treasury Tribal Advisory Committee (TTAC) could sunset upon publication of regulations. The Act provides ongoing duties for the Tribal Advisory Committee and the TTAC has been proven a useful component of federal-Native nations relations.

Accordingly, the Tribal Advisory Committee should be renamed Tribal Government Advisory Committee to clarify that is an adjunct to government-to-government consultation and nation-to-nation relations, and is not subject to the Federal Advisory Committee Act or sunset provisions. A TGWEA amendment is in order, that is:

- The Tribal Advisory Committee established by Public Law 113-168 shall be an ongoing aspect of America’s treaty and trust responsibility to Indian tribal governments and shall further the nation-to-nation relations between the United States and Native nations.

- The Tribal Advisory Committee shall advise the Secretary on matters relating to the taxation of Indians and the tax status of Indian nations, finance, international trade and commerce, economic development, efforts to raise the standard of living in Indian country, federal treaty and trust responsibilities, government-to-government consultation, and nation-to-nation relations.

Indian Country also needs to make the Treasury Office of Tribal and Native Affairs permanent with its mission to staff the TTAC and engage with Native nations on finance, trade and commerce, economic development, and programs to raise standards of living in and with Indian Country, and matters relating to Indian tribal government tax status and taxation of Indians.

Indian nations and tribal governments are also seeking enactment of the Tax Parity and Fairness Bill to provide tax fairness for Indian nations and tribes, including treatment of Indian tribes as states for tax exempt bonds, tribal new market tax credits, tribal low income housing tax credits, updated Indian employment tax credit on income and payroll taxes, and a tax credit for non-Indians who transfer lands to Indian tribes or Indians in historic tribal areas.

“When European colonial powers began to explore and colonize this land, they entered into treaties with sovereign Indian nations” stated President Ronald Reagan in his American Indian Policy Statement of January 24, 1983. The recognition of tribal sovereignty has been recognized from Washington to Reagan, and the Trump administration.

Indian Country has waited for these measures for many years. As a major new tax policy moves forward, Native America must stand together to ensure respect for tribal governments and Native people in line with the Constitution, our treaties and the federal trust responsibility.

Ernest L. Stevens, Jr. is Chairman of the Indian Gaming Association. He can be reached by calling (202) 546-7711 or visit www.indiangaming.org.