DETROIT, MI – Michigan tribal and commercial operators in April reported a combined $163.1 million total gross internet gaming receipts and gross sports betting receipts. Receipts increased a fractional 0.6 percent compared with March results.

April internet gaming gross receipts were a Michigan record of $132.4 million, surpassing the previous total gross receipts record of $131.67 million set in March. gross sports betting receipts were $30.7 million.

Combined total adjusted gross receipts and adjusted gross sports betting receipts were $136 million, including $119.3 million from internet casino gaming and $16.7 million from internet sports betting. Monthly internet gaming adjusted gross receipts were a fractional 0.6 percent higher than in March, and internet sports betting adjusted gross receipts rose 13.9 percent.

Compared with April 2021, internet gaming adjusted gross receipts increased 34.3 percent, and internet sports betting adjusted gross sports betting receipts were 53.5 percent higher.

Total internet sports betting handle at $371.2 million was down by 17.8 percent compared with March results.

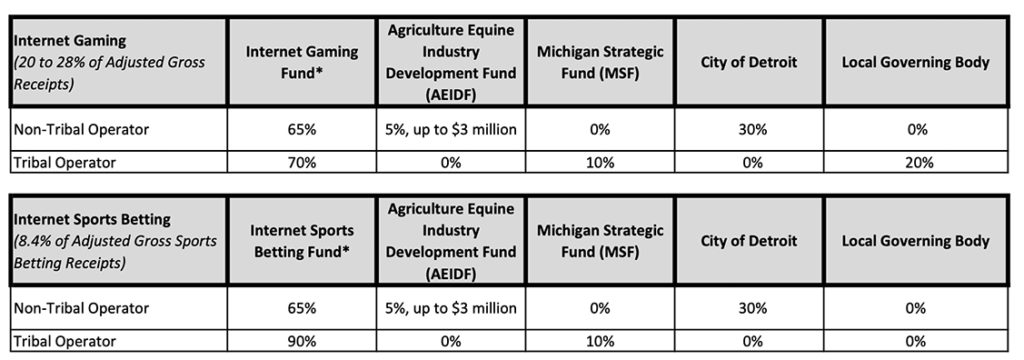

The operators submitted $25.2 million in taxes and payments to the State of Michigan during April including:

- Internet gaming taxes and fees: $24.3 million

- Internet sports betting taxes and fees: $944,006

The three Detroit casinos reported paying the City of Detroit $7.2 million in wagering taxes and municipal services fees during April including:

- Internet gaming taxes and fees: $6.6 million

- Internet sports betting taxes and fees: $594,949

Tribal operators reported making $2.7 million in payments to governing bodies.

For the first four months of 2022, aggregate internet gaming adjusted gross receipts totaled $457.6 million, and aggregate internet sports betting adjusted gross receipts were $46.6 million.