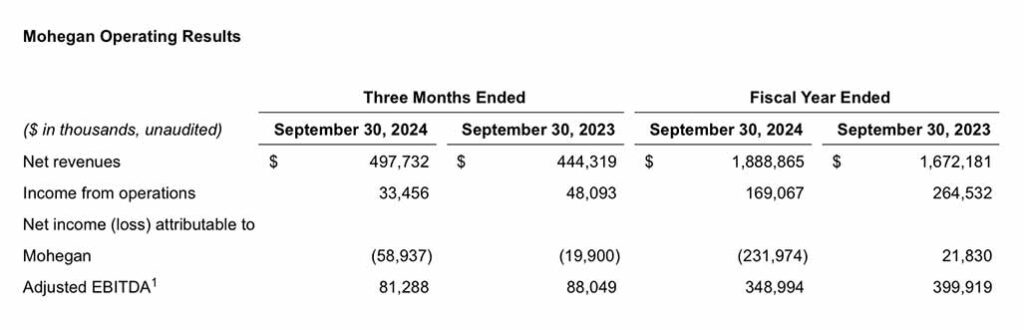

UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its fourth quarter and full fiscal year ended September 30, 2024.

Fourth Quarter 2024 Highlights:

- Mohegan achieved its second highest quarterly net revenues in our history, up 12.0% year over year.

- Mohegan Digital Adjusted EBITDA up 59.9% year over year.

- Mohegan INSPIRE generated net revenues of $62.2 million.

Full Fiscal Year 2024 Highlights:

- Mohegan achieved its highest annual net revenues in our history, up 13.0% year over year.

- Mohegan Digital net revenues up $60.1 million year over year.

- Mohegan INSPIRE generated net revenues of $163.3 million since opening.

“It’s been 30 years since the Mohegan Tribe was granted federal recognition in 1994, and in that time since we opened the Mohegan Sun here in Connecticut, we have transformed Mohegan from a regional, single casino, into one of the premier global integrated omnichannel resort operators,” said Raymond Pineault, CEO of Mohegan. This year marks the culmination of a number of important initiatives, which enables us to build on these accomplishments and remain focused on executing our strategy.”

Operating Results

Fourth Quarter 2024: “Net revenues of $497.7 million increased $53.4 million compared with the prior-year period, primarily due to continued growth in Mohegan Digital and revenue from Mohegan INSPIRE,” said Ari Glazer, Chief Financial Officer of Mohegan. “Consolidated Adjusted EBITDA of $81.3 million decreased $6.8 million compared with the prior-year period, primarily due to operating costs related to the opening of Mohegan INSPIRE, low table hold at Mohegan INSPIRE, an $11.9 million non-cash adjustment to the value of a customer contract asset at Niagara Resorts, and a full quarter of ilani management fees earned in the prior-year period, partially offset by strong growth in our Digital operations.

Full Fiscal Year 2024: “Net revenues of $1.9 billion increased $216.7 million compared with the prior-year period, due to the addition of Mohegan INSPIRE, continued growth in Mohegan Digital, and strong non-gaming revenues at our other resorts,” said Ari Glazer, Chief Financial Officer of Mohegan. “Consolidated Adjusted EBITDA of $349.0 million decreased $50.9 million compared with the prior-year period, primarily due to operating costs related to the opening of Mohegan INSPIRE, low table hold at Mohegan INSPIRE, an $11.9 million non-cash adjustment to the value of a customer contract asset at Niagara Resorts, $12.1 million in non-controlling interest at Niagara Resorts, and a full year of ilani management fees earned in the prior-year period, partially offset by strong growth in our Digital operations.”

Domestic Resorts

Fourth Quarter 2024: Net revenues of $327.1 million increased $36.2 million compared with the prior-year period, primarily due to strong gaming and non-gaming revenues. The non-gaming growth was driven by strong entertainment revenues in the period. Adjusted EBITDA of $88.9 million increased $21.9 million and Adjusted EBITDA margin of 27.2% was 414 bps favorable compared with the prior-year period.

Full Fiscal Year 2024: Net revenues of $1.2 billion increased $34.6 million compared with the prior-year period, primarily due to higher non-gaming revenues. The non-gaming growth was driven by strong entertainment, food and beverage revenues in the period. Adjusted EBITDA of $318.9 million increased $8.3 million and Adjusted EBITDA margin of 25.9% was flat compared with the prior-year period.

International Resorts

Fourth Quarter 2024: Net revenues of $125.4 million increased $36.7 million compared with the prior-year period, driven by Mohegan INSPIRE and partially offset by Niagara’s results, which were negatively impacted by a $19.8 million, before non-controlling interest, non-cash adjustment to the value of a customer contract asset. Adjusted EBITDA loss of $11.5 million was primarily due to operating costs related to the opening of Mohegan INSPIRE, low table hold at Mohegan INSPIRE, and an $11.9 million non-cash adjustment to the value of a customer contract asset at Niagara Resorts.

Full Fiscal Year 2024: Net revenues of $448.2 million increased $133.6 million compared with the prior-year period, primarily driven by the continued ramp of Mohegan INSPIRE. Adjusted EBITDA loss of $36.1 million was primarily due to operating costs related to the opening of Mohegan INSPIRE, low table hold at Mohegan INSPIRE, an $11.9 million non-cash adjustment to the value of a customer contract asset at Niagara Resorts, and $12.1 million in non-controlling interest at Niagara Resorts.

Mohegan Digital

Fourth Quarter 2024: Net revenues of $43.9 million decreased $6.2 million compared with the prior-year period, due to a cumulative fiscal year 2023 accounting adjustment in the prior-year period which increased net revenues to account for iGaming tax reimbursements from our iGaming partners, and for a net-neutral outcome, increased expenses by an equivalent amount, for tax payments made to the state. Adjusted EBITDA of $19.4 million was $7.3 million favorable compared with the prior-year period, due to strong growth in our Mohegan Digital operations.

Full Fiscal Year 2024: Net revenues of $160.7 million increased $60.1 million compared with the prior-year period, primarily due to robust growth in our Connecticut digital operations. Adjusted EBITDA of $79.2 million was $30.0 million favorable compared with the prior-year period, as Mohegan Digital continues to experience rapid growth.

Management, Development & Other

Fourth Quarter 2024: Net revenues of $11.6 million decreased $36.9 million compared with the prior-year period. The decrease is attributed to the prior year benefiting from a full quarter of ilani management fees, Mohegan INSPIRE development fees, and higher inter-company entertainment revenues. Adjusted EBITDA loss of $2.2 million was $24.0 million unfavorable compared with the prior-year period.

Full Fiscal Year 2024: Net revenues of $71.7 million decreased $38.7 million compared with the prior-year period, primarily driven by a full year of ilani management fees earned and Mohegan INSPIRE development fees in the prior-year period. Adjusted EBITDA of $28.4 million was $39.8 million unfavorable compared with the prior-year period.

Corporate & Other

Fourth Quarter 2024: Adjusted EBITDA was $2.2 million unfavorable compared with the prior-year period, primarily due to higher Corporate labor costs. Net loss was $8.8 million unfavorable compared with the prior-year period, primarily due to a loss on fair value adjustment attributable to changes in the estimated value of the warrants and put option related to our Korea Term Loan.

Full Fiscal Year 2024: Adjusted EBITDA was flat compared with the prior-year period, primarily due to Corporate cost management. Net loss was $91.8 millionunfavorable compared with the prior-year period, primarily due to a loss on fair value adjustment attributable to changes in the estimated value of the warrants and put option related to our Korea Term Loan.

Liquidity

As of September 30, 2024, and September 30, 2023, Mohegan held cash and cash equivalents of $204.8 million and $217.3 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $187.2 million of borrowing capacity under its senior secured credit facility and line of credit as of September 30, 2024. In addition, inclusive of letters of credit, which reduce borrowing availability, Niagara Resorts had $37.0 million of borrowing capacity under its revolving credit and swingline facility as of September 30, 2024.