UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its third fiscal quarter ended June 30, 2024.

Third Quarter 2024 and Recent Highlights:

- Mohegan achieved its highest quarterly net revenues in its history, up 21.4% year over year.

- Mohegan Digital net revenues up 151.3% year over year.

- Inspire generated net revenues of $101.1 million since opening.

- Joe Hasson appointed to Chief Operating Officer of Mohegan.

- Mohegan Sun Arena hosted its 3,000th show and received three national awards for Best Casino/Resort Arena.

“As I look across our enterprise, I feel confident about how our strategy is taking shape and I’m excited about our near and long-term prospects,” said Raymond Pineault, CEO of Mohegan. “The combination of profitable growth in Digital, the ramp at Inspire since the grand opening in March, combined with the stability and resilience of our flagship, Mohegan Sun in Connecticut, highlights some of the important drivers for our growth in the present and future.”

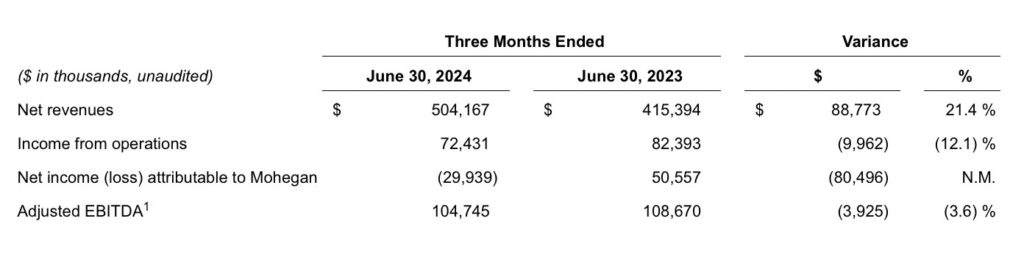

Mohegan Operating Results:

“Net revenues of $504.2 million increased $88.8 million compared with the prior-year period, primarily due to continued growth in Mohegan Digital and revenue from Mohegan Inspire,” said Ari Glazer, CFO of Mohegan. “Consolidated Adjusted EBITDA of $104.7 million decreased $3.9 million compared with the prior-year period, primarily due to operating costs related to the opening of Mohegan Inspire and non-controlling interest adjustments at Niagara Resorts, offset by strong growth in our Digital operations. Excluding the adjustment of non-controlling interest at Niagara Resorts, Adjusted EBITDA would have been $108.3 million or flat to prior year.”

Domestic:

Net revenues of $310.7 million increased $8.0 million compared with the prior-year period, primarily due to higher non-gaming revenues. The non-gaming growth was driven by strong entertainment, food and beverage revenues in the period. Adjusted EBITDA of $82.2 million and Adjusted EBITDA margin of 26.5% was 94 bps unfavorable compared with the prior-year period.

International:

Net revenues of $135.4 million increased $54.3 million compared with the prior-year period, primarily driven by Mohegan Inspire. Adjusted EBITDA loss of $2.1 million was unfavorable, primarily due to operating costs related to the opening of Mohegan Inspire and a $3.6 million non-controlling interest adjustment related to Niagara Resorts. Excluding the adjustment for non-controlling interest, Adjusted EBITDA would have been $1.5 million, which presents a more accurate comparison with prior periods.

Mohegan Digital:

Net revenues of $41.9 million increased $25.2 million compared with the prior-year period, primarily due to strong growth in their Connecticut digital operations. Results were partially impacted by $6.0 million in iGaming tax reimbursements from their iGaming partners being included as an increase to both net revenues and expenses in the current year. Adjusted EBITDA of $23.1 million was $11.5 million favorable compared with the prior-year period, as Mohegan Digital continues to experience strong growth.

Management, Development and Other:

Net revenues of $22.5 million increased $1.0 million compared with the prior-year period, driven by higher management fee and inter-company entertainment revenues, partially offset by Mohegan Inspire development fees earned in the prior-year period. Adjusted EBITDA of $11.2 million was $5.2 million unfavorable compared with the prior-year period, primarily due to Mohegan Inspire development fees earned in the prior-year period.

Corporate and Other:

Adjusted EBITDA was $0.7 million favorable compared with the prior-year period, primarily due to corporate labor savings. Net loss was $45 million unfavorable compared with the prior-year period, primarily due to a loss on fair value adjustment driven by changes in the estimated value of the warrants and put option related to their Korea Term Loan.

Liquidity:

As of June 30, 2024 and September 30, 2023, Mohegan held cash and cash equivalents of $180.9 million and $217.3 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $170.0 million of borrowing capacity under its senior secured credit facility and line of credit as of June 30, 2024. In addition, inclusive of letters of credit, which reduce borrowing availability, Niagara Resorts had $36.5 million of borrowing capacity under its revolving credit and swingline facility as of June 30, 2024.