UNCASVILLE, CT – Mohegan Tribal Gaming Authority has released operating results for its third fiscal quarter ended June 30, 2023.

Mohegan Operating Results

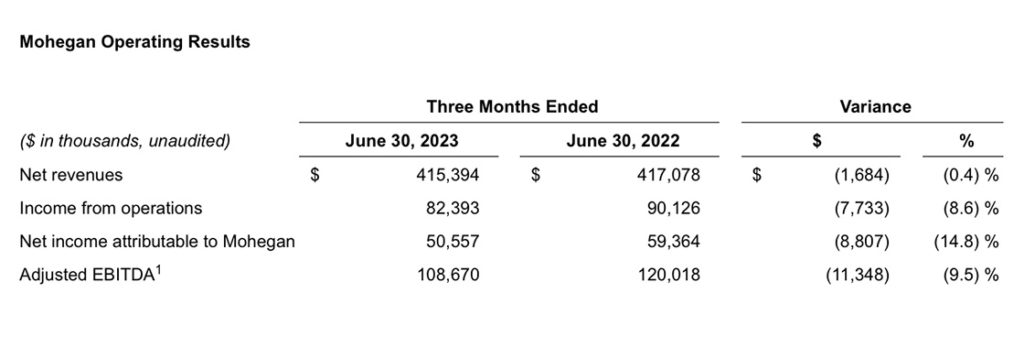

“Our consolidated Adjusted EBITDA of $108.7 million was the third highest quarterly total in our 26-year history, while the prior-year comparable quarter was the highest to date,” said Raymond Pineault, Chief Executive Officer of Mohegan. “We continue to see strong results from our digital segment and are focused on growing that line of business.”

“Our Adjusted EBITDA margin of 26.2% was 268 basis points favorable compared with our pre-COVID-19 third quarter of fiscal 2019 and 262 basis points unfavorable compared with the prior-year period,” said Carol Anderson, Chief Financial Officer of Mohegan.

Mohegan Sun

Net revenues decreased $5.8 million compared with the prior-year period primarily due to lower slot and table games volumes. Strong non-gaming growth driven by food, beverage, entertainment, and hotel revenues partially offset the decline in gaming revenues. Adjusted EBITDA of $68.5 million was 9.5% unfavorable compared with the prior-year period. The Adjusted EBITDA margin of 29.7% was 289 basis points favorable compared with the pre-COVID-19 third quarter of fiscal 2019 and 232 basis points unfavorable compared with the prior-year period.

Mohegan Pennsylvania

Net revenues decreased $1.5 million compared with the prior-year period primarily due to lower gaming volumes, which were partially offset by strong food, beverage, and hotel revenues. Adjusted EBITDA of $14.1 million was 5.8% unfavorable compared with the prior-year period. The Adjusted EBITDA margin of 21.6% was 26 basis points unfavorable compared with the pre-COVID-19 third quarter of fiscal 2019 and 81 basis points unfavorable compared with the prior-year period.

Niagara Resorts

Net revenues increased $1.5 million compared with the prior-year period primarily driven by the continued ramp of non-gaming amenities, including as a result of the recently opened OLG Stage entertainment venue. Gaming revenues decreased $5.2 million compared with the prior-year period due to lower slot volumes. The prior-year period also benefited from favorable table games hold percentage. The Adjusted EBITDA of $14 million was 28.5% unfavorable compared with the prior-year period. The Adjusted EBITDA margin of 17.3% was 175 basis points favorable compared with the pre-COVID-19 third quarter of fiscal 2019 and 732 basis points unfavorable compared with the prior-year period. The decrease in Adjusted EBITDA is primarily due to higher costs associated with the reintroduction of certain non-gaming amenities that operate at a lower margin.

Mohegan Digital

Net revenues increased $6 million compared with the prior-year period, driven by strong growth in our Connecticut digital business and the recent addition of digital gaming in Ontario. Adjusted EBITDA of $11.6 million was $4 million favorable compared with the prior-year period. In the prior-year comparable period, Mohegan Digital Connecticut benefited from a cumulative update to the revenue share allocation from their digital gaming partner, which impacted net revenues and Adjusted EBITDA.

Management, development and other

Adjusted EBITDA of $10 million was $1.6 million unfavorable compared with the prior-year period, primarily due to an increase in labor costs related to management and development operations and loss on foreign currency. Net income for the period was $6.4 million favorable compared with the prior-year period, primarily due to a higher gain on fair value adjustment driven by changes in the estimated value of the warrants and put option along with lower interest expense, both related to the Mohegan Inspire financing.

All other

Adjusted EBITDA of $0.4 million was 49.1% unfavorable compared with the prior-year period, primarily due to decreased gaming revenues at Mohegan Casino Las Vegas, resulting from unfavorable table games hold percentage.

Corporate

Adjusted EBITDA was $1 million favorable compared with the prior-year period, primarily due to lower employee-related costs.

Liquidity

As of June 30, 2023 and September 30, 2022, Mohegan held cash and cash equivalents of $188.2 million and $164.7 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $227.8 million of borrowing capacity under its senior secured credit facility and line of credit as of June 30, 2023. In addition, inclusive of letters of credit, which reduce borrowing availability, the Niagara Resorts had $124.5 million of borrowing capacity under the Niagara Resorts revolving credit facility and swingline facility as of June 30, 2023.