UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its first fiscal quarter ended December 31, 2024.

First Quarter 2025 and Recent Highlights:

- Mohegan’s net revenues increased $73.7 million year over year.

- Mohegan Digital Adjusted EBITDA increased 52.1% year over year.

- Mohegan INSPIRE generated net revenues of $63.5 million.

“During 2024, Mohegan rolled out a number of important initiatives as part of our strategy to become one of the premier global omnichannel resort operators,” said Raymond Pineault, Chief Executive Officer of Mohegan. “Our success in accomplishing these transformational objectives is a credit to our incredible team, and as I look forward to 2025, I’m optimistic about the trends I see emerging within our omnichannel business and from the increased contributions by our non-gaming segments.”

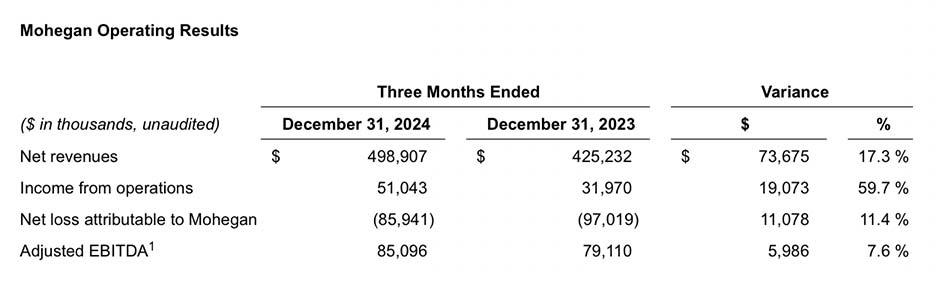

“Net revenues of $498.9 million increased $73.7 million compared with the prior-year period, driven by a strong quarter from Mohegan Sun and continued growth from Mohegan INSPIRE and Mohegan Digital,” said Ari Glazer, Chief Financial Officer of Mohegan. “Consolidated Adjusted EBITDA of $85.1 million increased $6.0 million compared with the prior-year period, as our Domestic Resorts, International Resorts, and Mohegan Digital outperformed prior year results.”

Domestic Resorts

Net revenues of $312.0 million increased $17.1 million compared with the prior-year period, driven by strong results from Mohegan Sun. Domestic Resorts’ gaming revenues increased $5.5 million, or 2.7%, and non-gaming revenues increased $11.6 million, or 12.6%. The non-gaming growth was primarily attributed to increased food, beverage, and entertainment revenues in the period. Adjusted EBITDA of $74.6 million increased $6.5 million and Adjusted EBITDA margin of 23.9% was 80 bps favorable compared with the prior-year period.

International Resorts

Net revenues of $135.7 million increased $56.4 million compared with the prior-year period, driven by Mohegan Inspire. Adjusted EBITDA of $4.1 million increased $10.0 million, or 168.9% compared with the prior-year period. The increase is primarily attributed to the continued ramp up of Mohegan Inspire and a favorable one-time property tax expense adjustment at Niagara Resorts.

Mohegan Digital

Net revenues of $53.1 million increased $16.9 million compared with the prior-year period, primarily due to strong results from our Connecticut operations. Adjusted EBITDA of $25.1 million was $8.6 million, or 52.1% favorable compared with the prior-year period.

Management, Development and Other

Net revenues of $5.1 million decreased $14.1 million compared with the prior-year period. Adjusted EBITDA loss of $4.8 million was $14.2 million unfavorable compared with the prior-year period. The decreases in net revenues and Adjusted EBITDA are attributed to the prior year benefiting from ilani management fees. Net loss for the current-year period includes accelerated amortization of the debt discount and deferred finance charges related to the Korea Term Loan.

Corporate and Other

Adjusted EBITDA was $4.9 million unfavorable compared with the prior-year period, primarily due to higher Corporate labor costs, which include labor costs that were previously recorded as non-EBITDA business transformation costs during the implementation of our new ERP system and increased consulting fees. Net loss in the current-year period includes a gain on fair value adjustment of $17.6 million on the warrants and put option related to our Korea Term Loan compared with a $62.6 million loss in the prior-year period.

Liquidity

As of December 31, 2024 and September 30, 2024, Mohegan held cash and cash equivalents of $192.7 million and $204.8 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $158.4 million of borrowing capacity under its senior secured credit facility and line of credit as of December 31, 2024. In addition, inclusive of letters of credit which reduce borrowing availability, Niagara Resorts had $34.8 million of borrowing capacity under its revolving credit and swingline facility as of December 31, 2024.

As discussed in Note 1 within the Quarterly Report for December 31, 2024, Mohegan has upcoming debt maturities and faces a financial covenant violation under its Korean Term Loan facility, which taken together present significant risks to investors. Investors are encouraged to review Mohegan’s Quarterly Report and Annual Report available on the Mohegan Gaming Investor Relations website, including the Financial Statements and Risk Factors, for additional information.