by Matthew J. Klas

Gas stations and convenience stores are an essential component of many tribal economies and will be especially integral to the economic recovery of Indian communities in the coming months. These tribally-owned and tribal-member owned facilities provide goods and services to area residents, keep revenue on the reservation and generate tax revenues for tribal governments. Onsite gaming can add even greater economic potential.

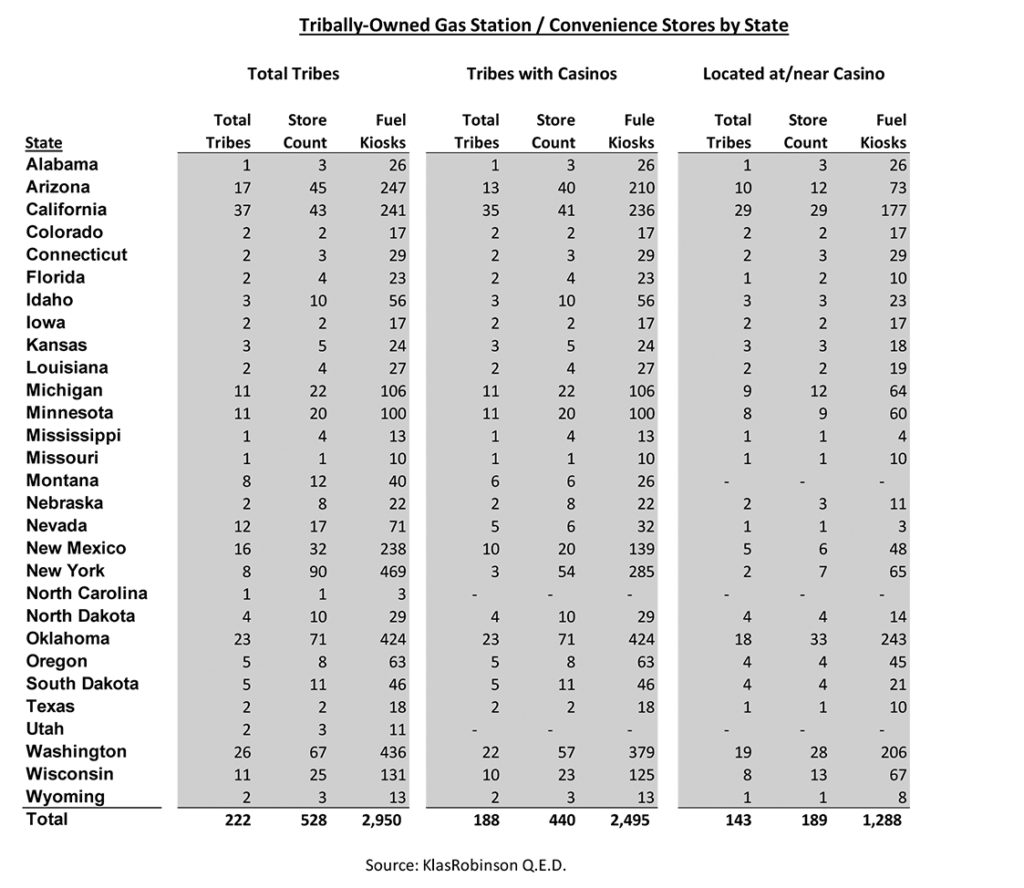

As of June 2021, there were 222 tribes with 528 tribally-owned and tribal member-owned gas stations/convenience stores (c-stores) in 29 states. These include 188 gaming tribes with 440 gas stations/c-stores, of which 189 gas stations/c-stores are located at or near a tribal casino. Table 1 presents a summary of tribally-owned or tribal member-owned gas stations/c-stores by state.

California has the greatest number of tribes with gas stations/c-stores (37 tribes), while Oklahoma has the greatest number of tribally-owned or tribal member-owned gas stations/ c-stores located at or near Indian casinos with 33 stores. With respect to total store count, New York ranks first with 90 stores, many of which are small operations owned by tribal members. Oklahoma ranks second with 71 tribally-owned and tribal member-owned gas stations/c-stores, followed by Washington with 67 stores, Arizona with 45 stores and California with 43.

Approximately 250 tribally-owned or tribal member-owned gas stations/c-stores (46.9 percent), carry a national fuel brand. Of those with national brands, 27.9 percent are Conoco Phillips (Conoco, Phillips 66, 76), 19.8 percent are Chevron (Chevron/Texaco), 17 percent Shell, 9.7 percent Exxon (Exxon/Mobil), and 3.6 percent BP. Other national brands with more than one store include Sinclair, Tesoro, Valero, Alon and Cenex.

Several tribes maintain their own fuel brands. The Choctaw Nation of Oklahoma has 17 Choctaw Travel Plaza locations; the Oneida Indian Nation of New York’s SavOn Convenience Store brand has 11 locations; the Winnebago Tribe of Nebraska, through Ho-Chunk, Inc., has 7 locations of the Pony Express/Heritage brand; and the Seneca Nation of New York has 5 Seneca One Stop locations.

Tribal branded c-stores are also found across Indian Country. In New Mexico, the Pueblo of Laguna, through its Laguna Development Corporation, has Route 66 Travel Centers and 66 Pit Stops (4 locations). In Oklahoma, the Chickasaw Nation has Chickasaw Travel Stops (8 locations). In Washington State, the Confederated Tribes of the Colville Reservation has Colville Fuels (8 locations), the Puyallup Tribe has Tahoma Market and Tahoma Express (6 locations), the Nisqually Indian Tribe has Nisqually Markets (6 locations) and the Spokane Tribe of Indians has Spoko Fuels (4 locations). In Wisconsin, tribal branded c-stores include the Ho-Chunk Nation’s WhiteTail Crossing brand (5 locations) and the Oneida Nation of Wisconsin’s Oneida One Stop brand (4 locations). Many tribal branded c-stores still carry national fuel brands.

Many gas stations/c-stores in Indian Country can boast of additional facilities and amenities. Of the 528 total stores, 16.5 percent have a drive-thru smoke shop, 8.5 percent have car washes, and 12.7 percent have showers, laundry and/or trucker lounges. Food and beverage offerings range from basic snack food and deli-type “grab-n-go” set ups to signature roadside diners. National fast-food franchises are also common. Popular franchises include Subway, Sonic, Burger King, McDonalds, Arby’s, A&W and Dairy Queen.

At the height of the pandemic, many consumers turned from grocery stores and restaurants to instead shop for food and other necessities at convenience stores. According to the Association for Convenience & Fuel Retailing, convenience stores nationwide experienced record in-store sales in 2020, up 1.5 percent from 2019 with basket sizes up 18.4 percent from 2019.

Several tribes have developed gas stations/c-stores with expanded grocery and convenience retail, emphasizing fresh food offerings prepared on site. The Choctaw Nation in Oklahoma has developed Choctaw Country Market, which features a full-service grocery store with sit-down deli area, made-to-order and pre-packaged meals, fresh produce, household necessities and an on-site butcher. Importantly for a socially distanced world, online ordering with curbside pickup is currently offered. To date, there are three Choctaw Country Markets – Clayton, Boswell and Coalgate, OK.

Another example is Maple Leaf Market, a convenience store brand developed by the Oneida Nation of New York, which focuses on providing healthier grab-and-go meals and made-to-order food, as well as grocery and essential items. Each property includes a full-service gas station and a touch-free car wash. To date, there are three locations – Sherril, Chittenango and Sylvan-Verona Beach, NY. Expanded convenience stores such as Maple Leaf Market and Choctaw Country Market can provide goods and services to their local communities and generate important tribal revenue.

The Indian gaming industry was hit particularly hard by the pandemic. However, the road to recovery looks promising with the Indian gaming industry projected to surpass 2019 revenue levels by the end of 2022. This growth is especially applicable for the 91 gas stations/c-stores that include on-site casinos, also known as “gasinos.”

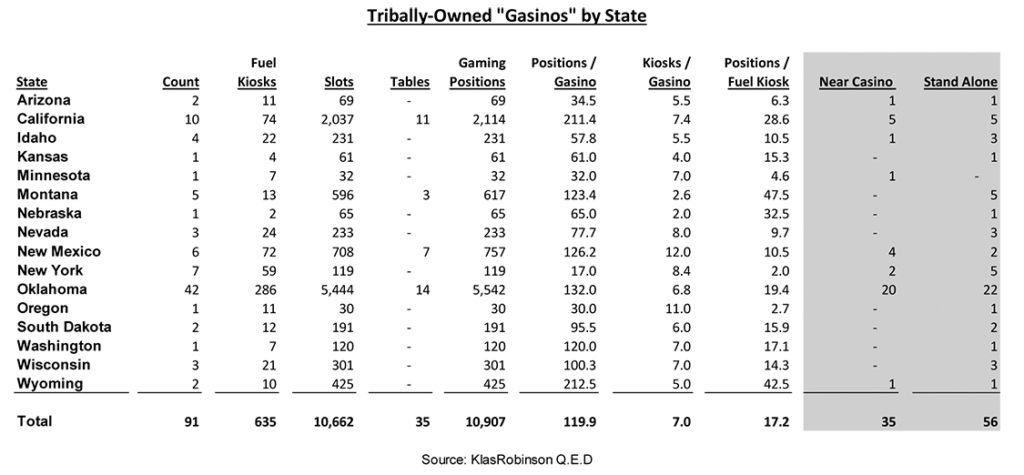

As presented in Table 2, these gasinos are located in 16 states with a combined total of approximately 10,700 slot machines, 35 table games and over 635 fuel kiosks. The typical tribally-owned gasino has approximately 119.9 gaming positions, 7 fuel kiosks and 17.2 gaming positions/fuel kiosk, however these figures vary significantly by state. Approximately 38.5 percent of gasinos are located in close proximity to the respective tribe’s main casino (i.e., adjacent to the main casino and/or near the main casino’s entrance), while 61.5 percent are stand-alone properties.

Oklahoma has 46.2 percent of all gasinos, 45 percent of gasino fuel kiosks and 50.8 percent of gasino gaming positions in the country with 42 properties, 286 fuel kiosks and 5,542 gaming positions. At the same time, Wyoming has the highest number of gaming positions per gasino at 212.5; New Mexico has the highest number of fuel kiosks per gasino at 12; and Montana has the highest number of gaming positions per fuel kiosk at 47.5.

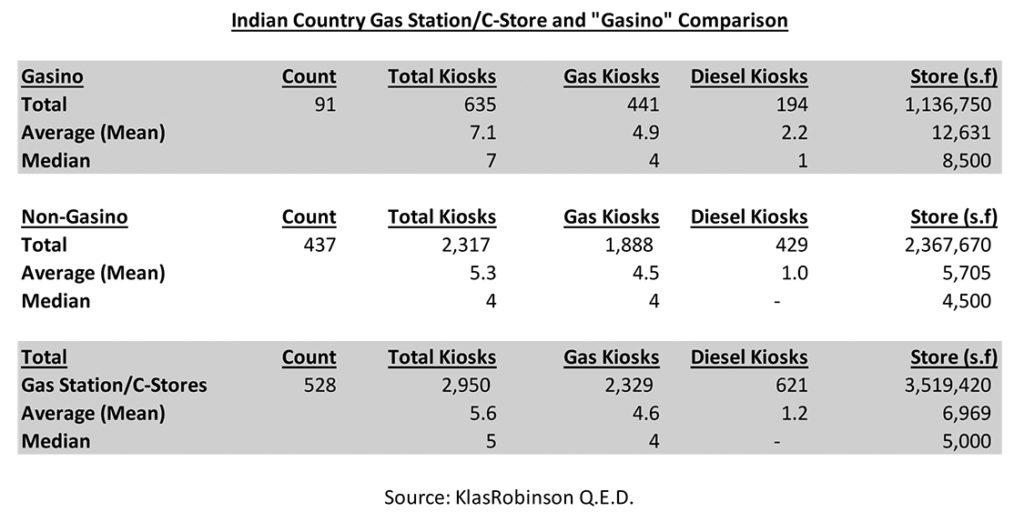

Indian Country gasinos tend to be physically larger than non-gaming gas stations/c-stores owned by Indian tribes or tribal members. Table 3 (on page 41) presents a comparison of tribally-owned and tribal member-owned gas stations/c-stores, with and without on-site gaming operations. While gasinos account for less than 20 percent of all stores, they have a higher average number of fuel kiosks and significantly larger average building square footage due to the additional space required by the gaming operation.

Gasinos have an average (mean) of 7.1 total fuel kiosks, 4.9 gasoline kiosks and 2.2 commercial diesel kiosks; and a median of 7 total fuel kiosks, 4 gasoline kiosks and 1 commercial diesel kiosk per operation. By comparison, tribally-owned and tribal member-owned gas stations/c-stores without on-site gaming operations have an average (mean) of 5.3 total fuel kiosks, 4.5 gasoline kiosks and 1 commercial diesel kiosks and a median of 4 total fuel kiosks, 4 gasoline kiosks and zero commercial diesel kiosks per operation.

With respect to building size, the average (mean) square footage for an Indian gasino is almost 13,000 sq. ft., while the median square footage is 8,500. In comparison, non-gaming gas stations/c-stores in Indian Country have an average (mean) square footage of 5,705 and a median square footage of 4,500 per store.

An excellent resource for tribes interested in the fuel and convenience store industry is the Tribal Convenience Store Association (TCSA), which represents 55 member tribes spanning multiple states. The TCSA’s mission is “Tribes helping tribes lead the convenience-store industry through peer networking, vendor partnerships, and member education.” Additional information about the TCSA can be found at www.tribalcstores.org.

Matthew J. Klas is a Senior Associate at KlasRobinson Q.E.D., a national consulting firm specializing in the feasibility and economic impact of casinos, hotels, and other related ancillary developments in Indian Country. He can be reached by calling (763)-257 7806 or email [email protected].