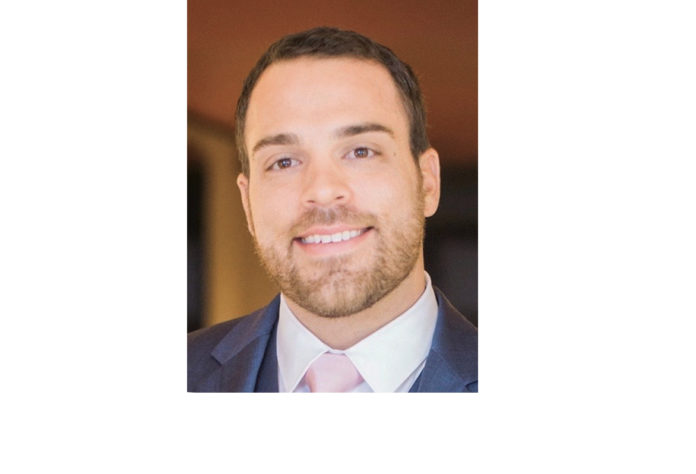

by Adam H. Smith

Adapting and responding to market innovation and changes in desired user experiences is one of the most difficult things a company must face, and this is especially true in the gaming industry today. There are multiple converging innovations and changes taking place in gaming including retail and mobile sports betting, cashless gaming floors, and the expansion of digital currencies. Throughout tribal gaming’s history, one of the most notable and significant technological developments came with the advent of ticket-in/ticket-out (TITO). This common practice today did not start with sweeping enthusiasm, as the fear of losing loyal patrons who preferred the sound and experience of physical coins was at the top of everyone’s mind. During this market change, many felt the switch to TITO was more impactful for the traveling tourist in Las Vegas, but not particularly needed for local tribal gaming facilities. Of course, time has provided the perspective of knowing that TITO was a major success, not only operationally from an efficiency and cost standpoint, but also because patrons have come to prefer the ease of a ticket versus carrying heavy coins.

Today, the industry faces another adaption, but in this case, the change has multiple angles of innovation happening at the same time. As it relates to these varying changes, whether it be mobile sports waging, cashless gaming devices, or mobile gaming in general, for simplicity it is referred to as cashless gaming. As gaming facilities have rolled out different forms of cashless gaming, a need has surfaced – the ability to conveniently use these new gaming experiences through a digital wallet, or mobile financial application. This gaming innovation is rather simple and has been around in commercial jurisdictions for years. For large gaming facilities that have the resources and capital to roll-out a proprietary digital wallet, the transition to cashless gaming is and will be rather simple. But what about the other 95% of tribal gaming facilities nationwide that will use some other kind of third-party digital wallet? There are several questions that must be answered prior to rolling out a mobile currency exchange infrastructure that can be used with gaming devices, connected to a sports wagering application, and used as payment for various accommodations. For example, what information is being provided to third-party providers? Are there privacy concerns? Is the provider of the digital wallet either directly or indirectly a competitor? What due diligence is needed by tribal gaming regulatory commissions and management? Ultimately, how will this affect traditional casino risks?

Several companies have developed proprietary digital wallets to sell across tribal gaming. A primary concern is data privacy and how much access these applications have to player data and activities. From a patron convenience standpoint, it makes sense for competing casinos to use the same digital wallet because the alternative is each casino using their own, which would then pose the question – how many digital wallets/ applications are people willing to have on a single device? Another question that arises is – are casinos increasing risks with cashless gaming and digital wallets or reducing risks?

When selecting a digital wallet provider, the following should be considered:

• Evaluate nearby casinos and their changes towards cashless gaming.

• Conduct hypothetical interviews with patrons (keep in mind, initially, customers were opposed to TITO).

• Evaluate the digital wallet suppliers for their involvement in other markets. Interview other casinos that have partnered with a given third-party provider.

• Consider how the digital wallet interacts with the gaming floor, back of house accounting, patron’s personal data, and sports betting.

As with many new innovations and technologies, a variety of traditional operational risks are removed while others are added. In the case of digital wallets and the elimination of nearly all cash in the casino, historical gaming risks of theft and physical misappropriation of funds is mostly removed. Employee theft and collusion has been a significant risk or area of concern to casino operations throughout the industry’s existence. Is cashless gaming eliminating the risk or simply shifting it to another operational area? As casinos become more reliant on technology and put more sensitive data into third-party applications and virtual infrastructure, regulatory bodies, casino management, and tribal officials should consider their due diligence as it relates to customer privacy and data security. While internal controls over counting cash through the drop and count may be eliminated/reduced, an entire new set of confirming controls should be present that are designed to protect not only the casino, but also patron funds. Historically, casino controls have been mostly manual due to the nature of operations, but when putting financial assets into a vendor supplied digital environment, significant controls over selecting and vetting a particular partnership are necessary. As in the TITO evolution, most small to mid-sized operations will likely wait for larger facilities to roll-out cashless gaming (and the vehicle behind its existence – digital wallets), but when this vehicle is not proprietary, and a casino is relying on a third-party, proper due diligence is vital.

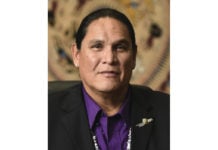

Adam H. Smith, CPA, is a Principal at REDW, LLC. He can be reached by calling (702) 472-8328 or email [email protected].